There are several important messages that I want to share with you that I have been discussing with my clients. Mortgage rates are dropping, unit sales are increasing, inventory is high, and prices are stable, but too many buyers continue to sit on their hands.

For many market segments, especially condos, there are some real bargains available. The market is in on the way up and we expect to see consistent price increases in the future. So it is surprising that so many buyers are sitting on their hands and waiting – for what?

Some consumers are waiting for price to decline in the GTA before they buy. I believe these consumers are dreaming in technicolor. Attached is a chart (Average GTA Prices Chart) showing the average prices for the GTA as stated by TRREB over the past 4 years. Despite 10 interest rate increases, prices have consistently averaged about $1,100,000 over four years, (this average excludes the 5 months in 2022, and market exceeded $1.2, and prices peaked at $1.33 Million). In September, the average price was $1,107,291. Apparently, the various factors that drive the GTA real estate market (i.e., Immigration, downsizing baby boomers, international students, millennials looking for houses, etc.) seems to be able to counteract 10 consecutive rate increases in the Bank of Canada Rate.

Some consumers seem to think that housing will become more affordable if they just wait for mortgage rates to drop further. Many consumers are unaware that the 5-year mortgage rate (not the Bank of Canada Rate) has already dropped almost 2 points since peaked last November. More significantly consumers appear to be oblivious to the fact that as unit sales increase and mortgage rates drop, prices will invariably increase.

The real issues is that the cost of almost any future price appreciation would more than eliminate any savings from anticipated mortgage rate reductions. Let me explain.

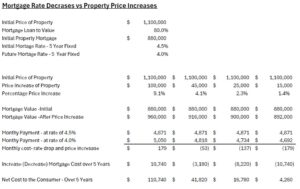

The Mortgage Rate Decrease vs Property Price Increase Chart shows the financial impact on a consumer over a five-year period if prices rise while mortgage rates drop. The Chart assumes the home buyer has a five-year fixed rate mortgage of 4.5% today and shows what will happen if rates drop down to 4%.For example, let us assume an average selling price of $1.1 million in the GTA as reported by TRREB in September. If the average property increased in price by only $25,000 (2.3%), the typical consumer would be worse off by $16,780, when you include the impact of the rate drop to 4% over a 5-year period. If the same property increases in price by $45,000 (i.e. an increase of 4.1%) the consumer would experience a net loss of almost $42,000 over a five-year period. Refer to the Mortgage Rate Decrease vs Property Price Increase Chart for the detailed calculations

There is clearly a real risk to sitting on your hands and waiting. This will only get worse in December when the Federal Government’s new mortgage affordability changes take place. Specifically, the 30-year amortization and the ability to insure properties of $1.5 million will only serve to increase prices as more consumers will be able to buy their next home.

The message is clear… clients should start to look for their new home or investment now! Consumers who decide to wait to buy a property next spring are making decision that will only cost them more money in the future.